SAMK has been active in Interreg Central Baltic projects supporting companies in developing business activities outside EU markets. The SME Aisle project team has worked on export activities in Southern African countries in the fields of trade, maritime and logistics, renewable energy, automation, and ICT. One of the SME Aisle project members, Tiina Mäkitalo, has also worked in an export project IHMEC that was targeting Saudi Arabian construction markets with indoor hygiene solutions that aim to break the chain of infection with built environment. The aim of this text is to compare these two markets as both projects have been funded by the Central Baltic program.

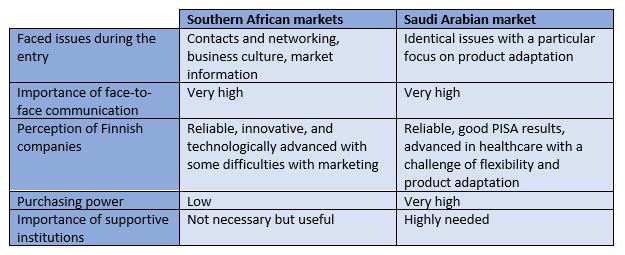

When looking at the similarities between the two markets first, the entry is quite the same since both markets bring identical challenges: contacts and networking, business culture, and market information. Similarities and differences are presented in Table 1.

Both the construction and the health care sectors are highly regulated, and the challenge for the IHMEC case was that providing the “Nordic solution” wasn’t sufficient, but it had to be adapted to local context in Saudi Arabia. The product must be more tailored based on the needs of the market and customers. To seek approval for the solution for instance, the IHMEC project targeted lead users and opinion leaders.

The second similarity is the importance of building trustworthy relationships. It imperatively begins by going into the country, experiencing the culture, and meeting people. In both situations, networking is the key to a successful entry and implementation. It is so important that it is almost impossible to establish a position without at least face-to-face communication.

To highlight the differences between the two areas: Finnish companies are perceived a bit differently from a country to another. In Southern African markets, it is seen as reliable, humble, and innovative. Finnish companies listen well and adapt their products well to the target market. They are usually seen as technologically advanced and having high standards. However, they are also perceived as bad marketers struggling to show the value proposition of the product (mainly based on practical aspects only).

The Saudi Arabian point of view is that Finland is a reliable and non-corrupted country known for its good PISA results, having advanced health care and being the happiest country in the world. Companies are seen as reliable, but maybe not so flexible compared to Saudi business culture where all business is personal. In addition, Finns are seen as less adaptive in Saudi Arabia. Saudis expect reactivity in business meaning that they would like partners to be in contact also outside the “business hours”. They also share business material via WhatsApp, which is not usual, or even not allowed in Finland.

The final variance is the purchasing power. Southern African countries (except South Africa) have a low purchasing power leading to a preference for B2B and B2G. Yet, Saudi Arabia is a very rich country with possibilities to purchase the best technologies. They favour American solutions and utilise those as standards. For Finnish solutions, the challenge is to convince the demanding customer about the novelty, high quality, and why it is “better than the American ones”.

All in all, both of the markets have high potential for business. Long term commitment from companies is needed for success.

Text: Arthur Dessenius, Tiina Mäkitalo, Minna M. Keinänen-Toivola

Photo: Pixabay: TheDigitalArtist